Travel and Expense

New Survey Uncovers Travelers’ Requirements for Return to Responsible Business Travel

While 96 percent of global business travelers are willing to travel for business over the next 12 months, addressing their demands for flexibility may prove essential for companies’ long-term success.

Timed with the SAP Concur Travel Industry Summit, new research commissioned by the SAP Concur organization in April – May 2021 highlights global business traveler enthusiasm to return to the road, while pointing to what companies are doing—and need to do—to ensure a productive return to responsible business travel.

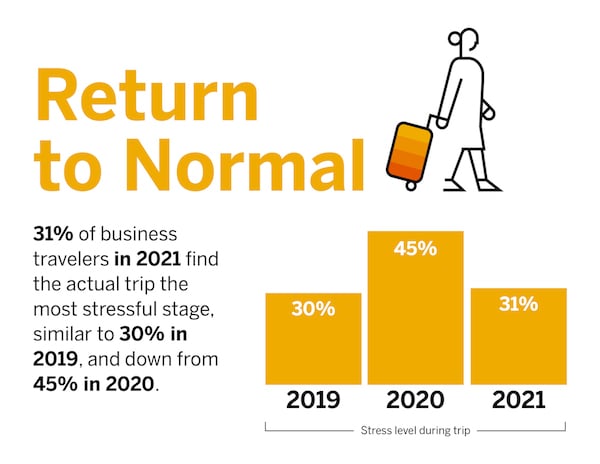

In 2020, business travelers found the trip itself to be the most stressful stage of travel, reflecting increased anxiety around safe travel during a global pandemic. The findings from this year’s survey suggest a return to pre-pandemic stress levels before, during, and after a business trip.

However, employees’ expectations of their employer to protect their health and safety while traveling for business remain. After a year of being grounded by events beyond their control, employees are ready to return to business travel, but on their own terms. The actions that companies take in the next 12 months could make or break their ability to acquire and retain valuable employees amid a competitive market for talent.

Read more: Global Business Traveler Report 2021

Key findings from the survey of 3,850 business travelers across 25 global markets and 700 travel managers in seven global markets include:

Global business travelers are enthusiastic about returning to travel, both for professional and personal reasons.

- Ninety-six percent are willing to travel for business over the next 12 months, including 65 percent who are very willing.

- The majority—68 percent— say they are pushing for a return to business travel, while just 32 percent feel their company is requiring them to do so.

- Baby Boomers are most likely to push their employers for the return to business travel (74 percent).

- Four in five business travelers worry that unless they increase business travel this year, their professional (80 percent) and personal lives (80 percent) will suffer.

- Professional concerns include the ability to develop and maintain business connections (45 percent), making less money (38 percent), and not advancing in their career (33 percent).

- One in five (18 percent)—including 29 percent of Gen Z respondents—worry they could lose their job if they are unable to increase their business travel.

- Personal reasons for business travel include making personal connections with customers and colleagues (54 percent), experiencing new places (52 percent), and taking a break from their everyday life (41 percent).

- One in five global business travelers are looking forward to having the ability to dress up to go somewhere (19 percent), and one in 10 say that their partner wants them out of the house (11 percent)!

- Professional concerns include the ability to develop and maintain business connections (45 percent), making less money (38 percent), and not advancing in their career (33 percent).

Although they are ready to hit the road again, global business travelers want to do so on their own terms.

- Flexibility, such as choosing transportation, lodging, and travel dates, is now the most pressing need for business travelers, ahead of their vaccination-related demands such as wanting themselves, or the clients or colleagues they visit, to be fully vaccinated against COVID-19 (72 percent vs. 62 percent).

- Flexibility has emerged as a top priority for younger generations, particularly in the U.S., where the majority of Gen Z business travelers (59 percent*) say they would rather have a crying toddler in the seat behind them than have no control over when and where they travel for work.

- Heavy workloads and unused vacation days also mean workers plan to make the most of any upcoming business travel—89 percent say they will add personal vacation time to their business trips in the next 12 months.

Global business travelers will hold themselves most accountable to protect their health and safety while traveling for business (42 percent), followed by their employer (22 percent).

- Eighty-nine percent expect their company to protect their health and safety while traveling by allowing them to select their preferred accommodations (46 percent), preferred mode of travel (43 percent), book travel directly on supplier websites (39 percent), and decide the length of their trip (39 percent).

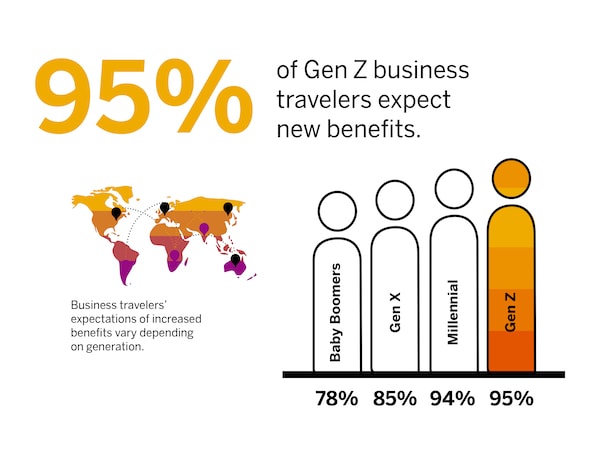

- While most of Gen Z (93 percent) and Millennials (92 percent) expect changes, only 76 percent of Baby Boomers do.

- New benefits that business travelers expect from their employers in the wake of the pandemic include the ability to choose direct flights (52 percent), stay in four- to five-star hotels (41 percent), and select premium seating, like first or business class (39 percent).

If their company doesn’t meet these expectations, business travelers—especially those from younger generations—intend to act.

- Almost a third of business travelers (31 percent) would ask to limit travel if their company does not implement policies or measures to help protect their health and safety. One out of five business travelers (20 percent) would go as far as looking for a different position.

- The issue is even more important for younger generations—more than half (56 percent) of Gen Z and Millennial respondents would ask to limit travel or search for new positions.

- Gen Z and Millennial employees especially would be willing to walk: nearly a quarter (24 percent) of global Gen Z and Millennials would search for a new position.

- The risk is even greater for the youngest generation in the U.S.: a whopping 48 percent* of Gen Z respondents say they would search for a new position.

Read more: Global Business Travel Manager Report 2021

This climate puts additional pressure on travel managers, who must be extra vigilant to ensure policies match employee expectations.

- Nearly unanimously, global travel managers think their job will be more challenging in the next 12 months compared to last year (99 percent).

- The challenges facing global travel managers include communicating and ensuring compliance with new and revised company travel policies (60 percent), last-minute changes or cancelations to bookings (53 percent), and changes to government regulations (51 percent).

- All surveyed travel managers (100 percent) expect their company to implement some travel guidelines or policies in the next 12 months. However, their expected changes do not necessarily track to business traveler demands.

Enthusiasm for returning to travel, paired with the intent to act if their flexibility demands aren’t met, puts global business travelers in a unique power position. However, with an eye toward the right changes, organizations can encourage a productive return to business travel this year—and help achieve broader business goals in the process.

Expert panelists discussed findings from the research at the annual SAP Concur Travel Industry Summit. To access the recorded session, register here.

For more information, download the Business Traveler and Travel Manager whitepapers.

*Small base size; directional findings only.

The survey was conducted by Wakefield Research (www.wakefieldresearch.com), a leading independent provider of quantitative, qualitative and hybrid market research, among 3,850 business travelers defined as those who travel for business three or more times annually from the following markets: U.S., Canada, Brazil, Mexico, LAC (Colombia, Chile, Peru, and Argentina), UK, France, Germany, ANZ region (Australia and New Zealand), SEA region (Singapore and Malaysia), China, Hong Kong, Taiwan, Japan, India, Korea, Italy, Spain, Dubai, Benelux (Belgium, Netherlands, and Luxembourg), South Africa, Sweden, Denmark, Norway, and Finland. Additionally, Wakefield Research surveyed 700 travel managers from the following markets: U.S., Mexico, UK, France, Germany, SEA region (Singapore and Malaysia), and Hong Kong. Both surveys took place April – May 2021. For the interviews conducted in this study, the chances are 95 in 100 that a survey result does not vary, plus or minus, by more than 1.6 percentage points from the result that would be obtained if interviews had been conducted with all persons in the universe represented by the sample.